Executive Summary

PayPal’s PYUSD is gaining traction, but where does durable usage live and what drives it? Using data covering April 2024 to September 2025, we analyzed about 2 million PYUSD transfers across about 70 thousand users. Activity still concentrates in centralized venues. DeFi incentives lift activity while live, then fade without followups. On Solana, fewer users transact more and in larger sizes than on Ethereum, which is consistent with concentrated, incentive driven behavior. We compared Aave, Kamino, Drift, and Curve on incentive spend, TVL, and how much of that TVL remains once programs cool. Taken together, the data points to three moves for PYUSD and similar assets: focus incentives on broad, repeat usage instead of short term TVL spikes, favor venues that keep PYUSD active without rewards, and plan programs in stages from discovery to activation to retention.

Approach

With stablecoin adoption accelerating, teams need to understand how a well known brand’s stablecoin behaves in the wild and which venues show real, sustainable usage. We set out to answer that question and to show how Forse measures real usage. We turned that permissionless onchain analysis into a reusable Forse Terminal so the charts and metrics stay live and comparable across assets and venues. We joined transfer level data across Ethereum and Solana with protocol state and public incentive calendars for Aave, Kamino, Drift, and Curve. TVL was defined as deposits minus withdrawals. Users were segmented by frequency and size to form behavioral cohorts. Attribution looked for alignment between program windows, onchain payouts, and cohort or TVL shifts rather than single metric spikes. Constraints include partial visibility into historical incentives and compute intensive joins at scale. The work is independent, based on public onchain data, and not affiliated with, sponsored by, or endorsed by PayPal.

Results

Venue mix and centralized vs onchain

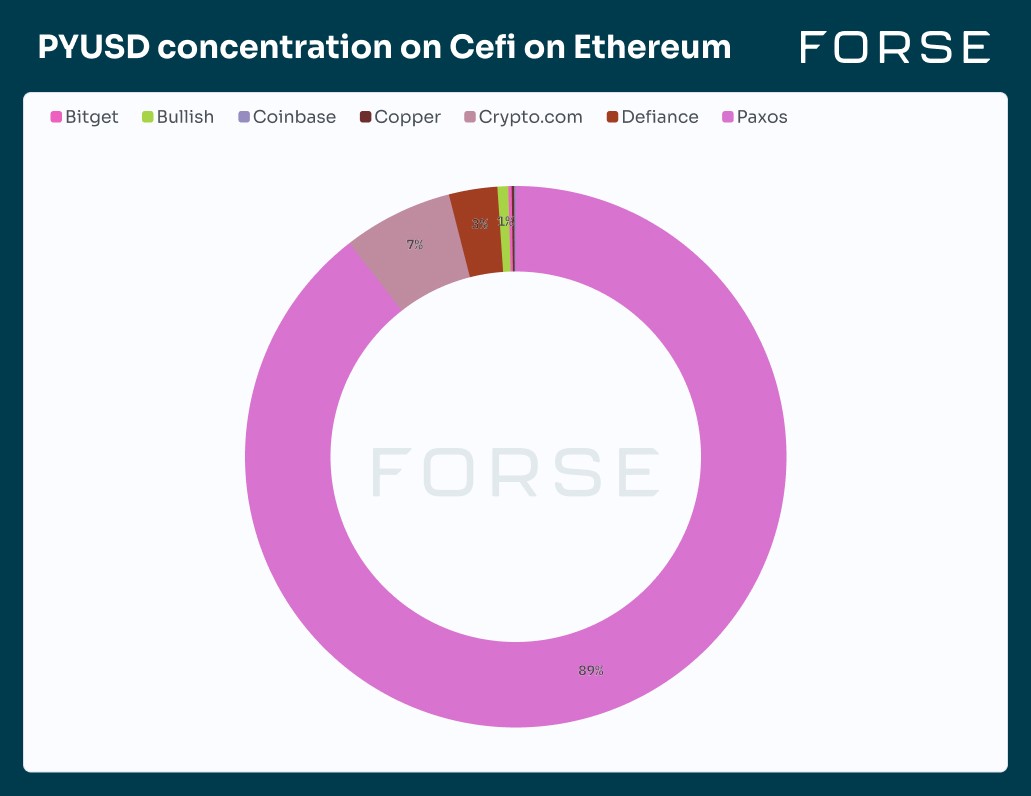

PYUSD usage still concentrates in centralized venues. Onchain activity in DeFi increases during incentive windows on Aave, Kamino, Drift, and Curve, but tends to settle back toward baseline once programs cool.

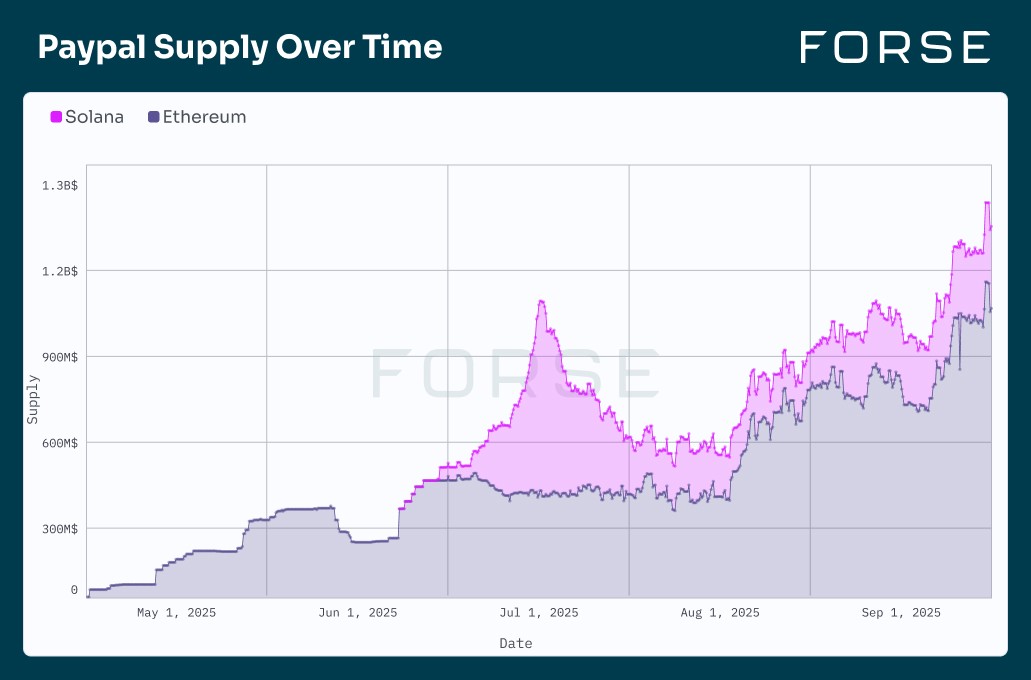

Over the same window, Ethereum kept the majority of PYUSD supply, briefly ceding market share to Solana during its 2024 ramp but stabilizing around 80% by September 2025, with Solana holding the remaining 20% as a volatile but important secondary hub.

Usage behavior and flows

Trading flow patterns show many users buying PYUSD in larger amounts, then using it to make smaller purchases of other tokens. For this group, PYUSD already behaves like a default stablecoin and routing asset, not just a balance to hold.

On Ethereum CeFi, most PYUSD TVL sits with Paxos Treasury, which supports the PayPal application. In practice this means the issuer controls the majority of PYUSD supply, while onchain markets and DeFi venues work with a smaller circulating float.

User segments and transitions

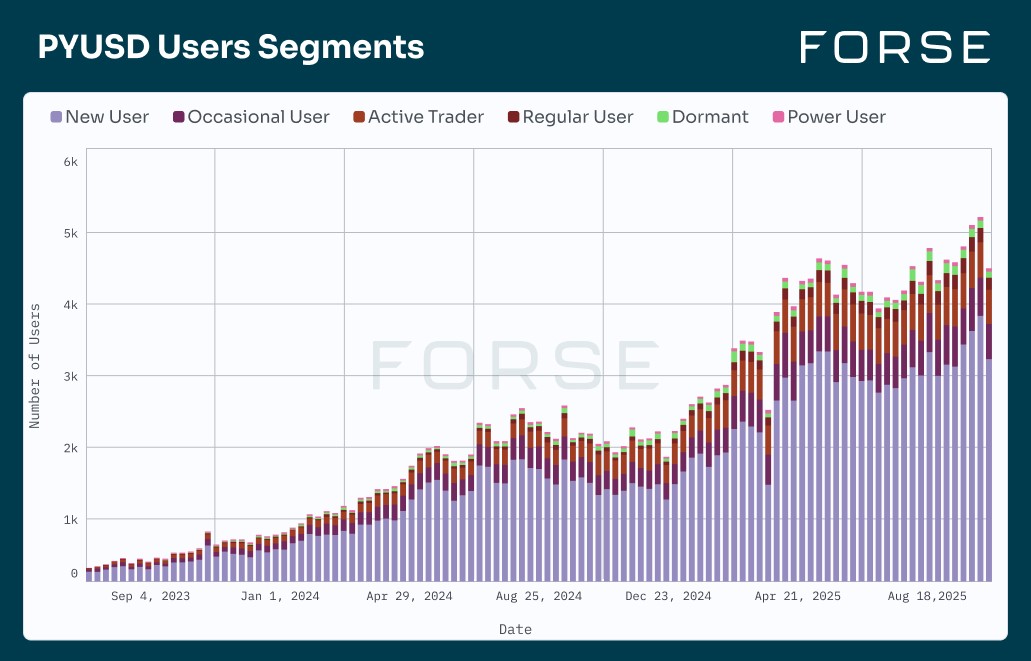

User segments group PYUSD holders into New User, Occasional User, Active Trader, Power User, Regular User, and Dormant cohorts, with internal bands like Plankton, Minnow, Dolphin, and Whale capturing balance and activity levels. This mix shows a broad base of small users under a very concentrated top of heavy, multi platform users.

While the user base has grown significantly, New Users still dominate the cohorts. Segment flows show that conversion into more active segments competes directly with churn into Dormant status, with a smaller share of users climbing the ladder from Occasional User to Active Trader to Power User before they drop off.

Chain and cohort pattern

On Ethereum, usage follows a clear power law. About 1,674 whale wallets move roughly 22.6B PYUSD in transfer volume, while around 84,753 plankton wallets together move about 24.5M PYUSD. Minnows and dolphins sit in the middle, with about 89.7M and 243.4M PYUSD in volume, which confirms that a very small share of users drives almost all onchain flow.

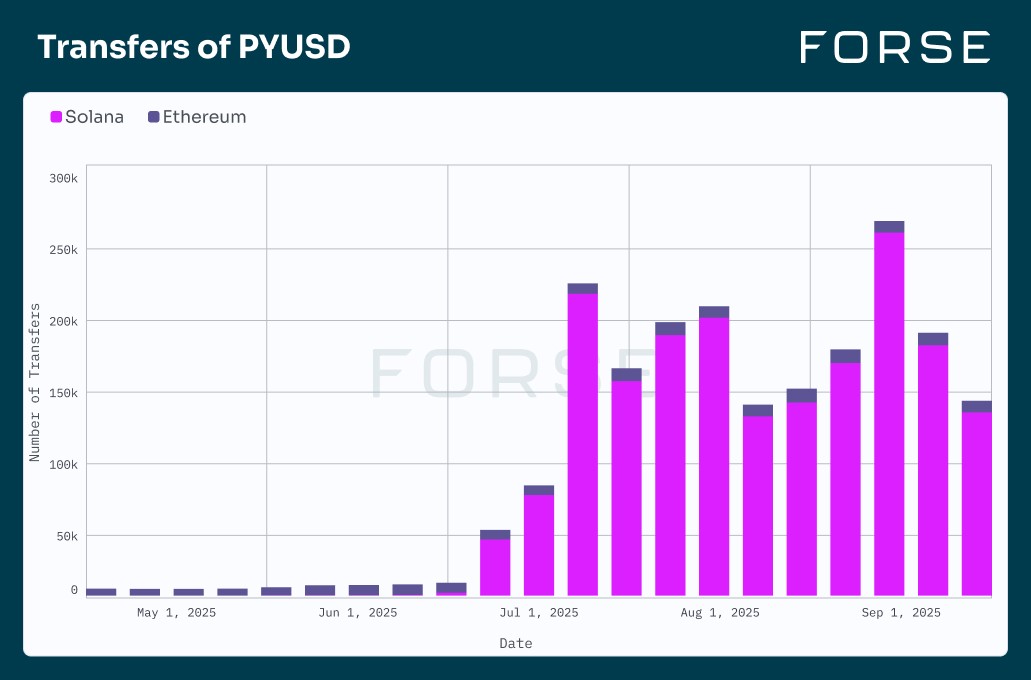

On Solana, PYUSD went from almost no activity in late April 2024 to a peak of about 2.5B PYUSD in monthly transfer volume by late August 2024, with transfers growing from single digits to more than 275k and unique senders rising toward 10k. From September 2024 onward, Solana remains highly active but more volatile, with volume and transfers cycling between peaks and dips, which is consistent with incentive driven waves rather than fully stabilized everyday usage.

Supply expansion

PYUSD supply across Ethereum and Solana grew in three distinct steps. Late April to early May 2024 marked the first Solana mints and about 125M PYSUD of net new supply. Mid May 2024 added roughly another 120M PYUSD, driven mainly by Solana’s ramp. August to early September 2025 added about 246M PYUSD, lifting combined PYUSD supply to around 1.35B PYUSD across both chains.

Ethereum has managed PYUSD supply actively since launch, with repeated large mints and burns, while Solana joined later with substantial mints and burns of its own. Large mints on one chain often align with large burns on the other, which looks like supply rebalancing between networks rather than purely organic issuance.

Since the end of this analysis window, PYUSD supply has continued to grow. External estimates put circulating PYUSD at over 3.8 billion dollars as of December 2025, making it one of the largest stablecoins by supply.

Aave, Kamino, Drift, Curve usage

Aave: incentives on Aave have been in the low hundreds of thousands of PYUSD, with PYUSD TVL rising from roughly 225–230M PYUSD before the program to peaks above 700M PYUSD in late 2024 and over 900M PYUSD by mid 2025. Supply grew as intended, but borrowed amounts fell, which suggests incentives over funded supply relative to borrower demand.

Kamino: incentives on Kamino total in the high single digit millions of PYUSD, with PYUSD TVL rising from roughly 40–45M PYUSD to peaks around 150M PYUSD in mid 2025. TVL then fell back, which matches the product insight that Kamino’s lucrative initiatives are effective at attracting liquidity but have difficulty maintaining it once rewards cool.

Drift: incentives on Drift are in the low single digit millions of PYUSD, with a sharp TVL increase at the start of the program followed by a considerable decline after the main incentive phase. This points to strong but short lived responsiveness to rewards.

Curve: rewards for holding PYUSD on Curve are in the low hundreds of thousands of PYUSD, yet PYUSD TVL on Curve trended down from early 2024 highs toward materially lower levels by late 2024 and mid 2025. That suggests other venues remained more attractive for PYUSD liquidity despite ongoing rewards.

What It Means

PYUSD already has scale, but onchain usage is narrow and uneven. On Ethereum, a very small set of whale wallets drives almost all volume, while a large long tail of smaller wallets is present but underused. On Solana, PYUSD saw an explosive ramp in transfers and senders followed by volatile waves, which is consistent with incentive driven activity rather than fully stabilized everyday usage.

Across Aave, Kamino, Drift, and Curve the pattern is similar. Incentives can buy TVL quickly, but only Aave shows a sustained TVL base, and even there borrowed amounts shrink as supply grows. Kamino and Drift pull in liquidity that is hard to keep once rewards cool, while Curve’s PYUSD TVL decays despite ongoing rewards. The practical implication is to design programs that balance discovery with durable breadth, focus on venues that retain usage without rewards, and use incentives to deepen real payment and RWA flows instead of just funding short term farming.

Lessons and Recommendations

Incentives are strongest while live. Recommendation: design lifecycle programs to discover, activate, and retain. Use cooldowns, tiered rewards and sybil guardrails.

TVL is not breadth. Recommendation: track new active wallets, first to second transaction rate, and day 7 repeat rate alongside TVL, and optimize programs against these metrics.

Concentration is a risk on both chains. Recommendation: design mechanics that spread rewards beyond whales and the most active addresses, for example with diminishing returns, per address caps, and cross venue tasks that push usage into more everyday flows.

Segment flows are the real funnel. Recommendation: monitor how many new and occasional users graduate into regular and power users versus becoming dormant, and use targeted campaigns or UX to move users up the ladder before they drop out.

Volume spikes are not attribution. Recommendation: maintain an incentive registry and align program timelines and payouts with cohort shifts, retention, and non incentivized usage, not just raw volume.

Durable adoption follows real usage and RWA paths. Recommendation: pair incentives with concrete use cases such as merchant payments or RWA access, and measure how much PYUSD is used as a routing or spending asset in those flows over time, while planning for incentive budgets that can withstand lower reserve yields over time.

View the full PYUSD analysis: https://insights.forse.io/paypal/pyusd_incentives_analysis

Book a Forse Demo

Get a clear view of where your asset is building durable traction and a program design that retains it. Request a demo or get started with Insights.

Share with your friends: