Introduction

We're excited to introduce the Uniswap Incentive Analysis Forse Terminal, providing comprehensive analytics on the Uniswap Revitalization and Growth Program across Arbitrum, Base, Scroll, and Blast. This tool empowers the Uniswap community to make data-driven decisions about future incentive strategies based on detailed performance metrics and user behavior analysis, as well as insights into whether the incentive campaign was successful.

Background

In February 2024, the Uniswap DAO introduced the Uniswap Revitalization and Growth Program, allocating over $3.5M in assets to incentivize users to participate in current and new deployments of Uniswap across various L2 networks. While the program successfully boosted initial liquidity, understanding its long-term impact and effectiveness required deeper analysis.

Recognizing this need, the Uniswap community approved a proposal to onboard Forse by StableLab as a data service provider. The goal was clear: analyze the effectiveness of the incentive program, identify which strategies delivered the best ROI, and provide actionable insights for future initiatives. With significant resources invested in growth, ongoing analysis became essential to ensure the DAO could evaluate and optimize its approach to market expansion.

The Terminal represents the culmination of this effort—a custom analytics platform designed to bring transparency to incentive performance and empower the community with the data needed to make informed decisions about Uniswap's growth strategy.

Key Features

The Terminal is divided into two tabs, providing a comprehensive analysis of incentive performance:

Program Overview:

Weekly TVL Breakdown: Understand the weekly evolution of Total Value Locked (TVL) influenced by incentives.

Chain-level Performance over Time: Explore how efficiently each chain converted incentives into incremental TVL.

User Segmentation Analysis: Dive deep into user (LPs) segments, understanding user tenure, and their retention rates.

Incentive Utilization Tracking: Track the lifecycle of incentives—how they were claimed, whether users held or sold them, and how these patterns evolved over time.

Pool-level Performance:

Individual Pool Insights: Discover detailed performance metrics on each incentivized pool, ranked by ROI, segmented by pool types (Stable, Pseudo-stable, and Volatile).

Post-Incentive TVL Analysis: Learn how each pool retained liquidity once incentives concluded, highlighting key trends in long-term liquidity retention and identifying pools that maintained or lost their TVL.

What the Data Reveals

The Impact Terminal reveals several critical insights about the Uniswap Revitalization and Growth Program:

Incentives Boosted TVL Significantly, but Retention Varied by Pool Type

The program led to immediate and significant liquidity increases across all four blockchains, with Base alone seeing average daily TVL increases exceeding $6M during the campaign. However, retaining this liquidity once incentives ended proved challenging, particularly on smaller chains like Scroll and Blast.

Pool Performance Varied Based on Pool Types

Our analysis shows distinct performance patterns across different pool types:

Stable pairs (e.g., FRAX/USDT, USDC/USDT) delivered strong immediate returns in both TVL and trading volume but experienced substantial liquidity outflows after incentives concluded.

Pseudo-stable pools (e.g., wstETH/WETH, cbETH/WETH) attracted significant liquidity but failed to generate proportional increases in trading volume and showed poor post-incentive retention.

Volatile ETH-stablecoin pairs demonstrated better long-term liquidity retention despite requiring higher upfront spending, making them more reliable sources of sustained liquidity.

Note: Bubble Size indicates the total quantity of all time LPs

Incentive Utilization Reveals Short-Term Liquidity Provider Behavior

Across all chains, the majority of incentivized liquidity providers displayed mercenary behavior, with over two-thirds of UNI rewards being sold immediately upon claim. This pattern indicates short-term profit motives rather than long-term commitment to the Uniswap ecosystem.

Chain-Specific Performance Varied Significantly

Base demonstrated relatively strong post-incentive retention, primarily driven by the WETH/USDC pool, despite fierce competition from Aerodrome.

Arbitrum initially suffered significant liquidity outflows, especially in stable and pseudo-stable pairs, but volatile pools like USDC/WETH later helped drive a recovery.

Scroll and Blast faced substantial challenges maintaining TVL gains post-incentives, with notable liquidity withdrawals shortly after campaign conclusion.

Key Performance Metrics

The Terminal quantifies key performance metrics that reveal both the immediate impact and long-term value of the incentive program. With $13.6M in TVL growth and $75.2M in weekly volume growth across 4.3k participants, the program achieved an impressive ROI of $1,281 additional TVL per dollar spent. However, the 47.3% 90-day retention rate and the fact that only 4.1% of distributed UNI was held by recipients underscores the challenge of converting short-term participation into sustained ecosystem engagement.

Explore the Terminal

You can explore the Forse Terminal at https://dub.sh/uniswap-terminal and discover insights that can inform your understanding of Uniswap's growth strategies. We welcome your feedback and suggestions as we continue to enhance the Terminal to better serve the Uniswap community.

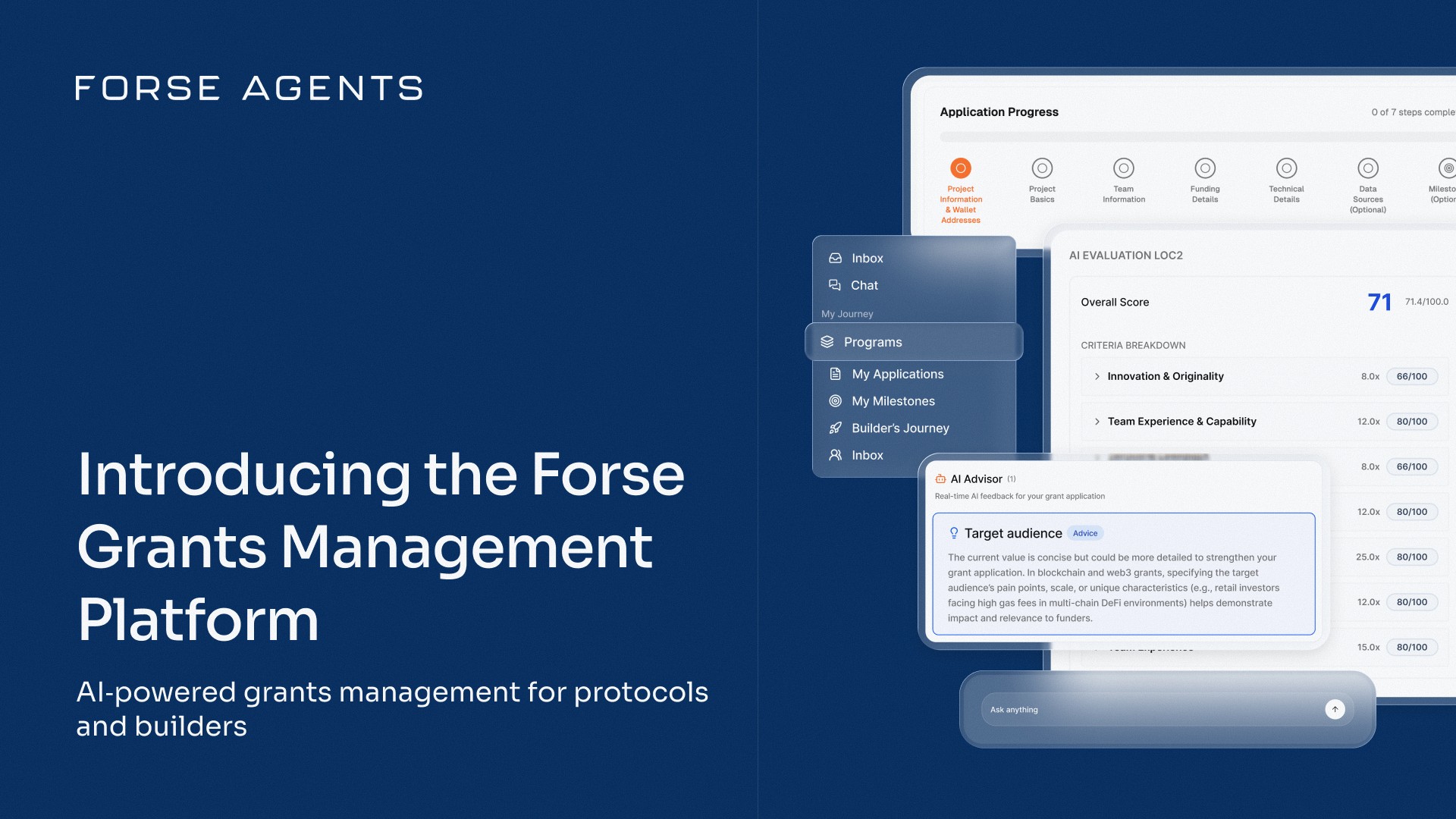

Partner with Forse for Data-Driven Growth

Forse transforms on-chain data into strategic insights that drive protocol growth and optimize resource allocation. Our analytics services help DAOs and protocols make informed decisions about incentive programs, liquidity strategies, and ecosystem expansion.

Whether you're launching a new incentive program, expanding to additional networks, or optimizing existing operations, our team combines DeFi expertise with advanced data science to deliver actionable insights.

Visit forse.io to learn more or contact us at hello@stablelab.xyz to discuss how we can support your protocol's growth objectives.

Share with your friends: